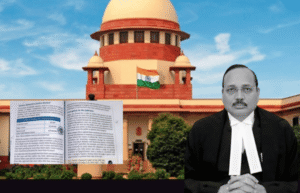

India’s Finance Minister Nirmala Sitharaman addressed Parliament today regarding the much-anticipated New Income-Tax Bill 2025. Her clear statement about no new rate being introduced brings relief to millions of taxpayers across India. The government’s primary focus remains on simplifying tax laws rather than increasing tax burdens on citizens.

Understanding the Core Changes in Tax Legislation

The New Income-Tax Bill 2025 represents a comprehensive overhaul of India’s existing taxation framework without altering rates. Finance Minister Sitharaman emphasised that the government’s simplification of tax laws remains the primary objective behind these reforms. Complex legal language will be replaced with clearer, more accessible terminology for average taxpayers.

Parliamentary discussions in the Rajya Sabha revealed extensive consultations with tax experts and legal professionals nationwide. The new legislation aims to eliminate ambiguities that have plagued taxpayers for decades through confusing provisions. Citizens can expect streamlined procedures and reduced compliance burdens moving forward through these changes.

Current tax rates across all income slabs will remain unchanged, providing stability for financial planning purposes. The government recognises the importance of predictable tax policies for economic growth and individual prosperity. This approach allows businesses and individuals to make informed decisions without worrying about sudden changes.

Key Features of the Simplified Tax Framework

The revised tax code introduces several improvements designed to enhance the taxpayer experience and reduce administrative complexity. Legal jargon will be replaced with plain English wherever possible to improve understanding among citizens. Professional tax preparers will also benefit from clearer guidelines and reduced interpretation challenges.

Major simplifications include:

- Streamlined filing procedures with fewer forms required

- Clearer definitions of taxable income categories

- Reduced documentation requirements for common deductions

- Simplified penalty structures with transparent calculation methods

- Enhanced digital integration for faster processing times

These changes address longstanding complaints about the complexity of India’s tax system while maintaining revenue collection efficiency. Small business owners and individual taxpayers will find compliance significantly easier under the new framework. The government expects reduced disputes and faster resolution of tax-related issues.

Parliamentary Response and Political Implications

Finance Minister Sitharaman’s announcement in Parliament received mixed reactions from opposition parties and tax policy experts. While most welcomed the simplification efforts, some questioned whether the changes go far enough. The ruling party emphasised that these reforms demonstrate their commitment to citizen-friendly governance approaches.

Opposition members raised concerns about implementation timelines and potential loopholes within the new legislation framework. Parliamentary committees will conduct detailed reviews before final passage to ensure comprehensive coverage of potential issues. Public consultations may continue throughout the legislative process to incorporate additional stakeholder feedback.

The timing of these announcements coincides with broader economic reforms aimed at improving India’s business environment. International observers note that simplified tax codes often attract foreign investment and encourage entrepreneurship. These changes align with India’s goals of becoming a more competitive global economy.

Impact on Different Taxpayer Categories

Salaried employees will experience the most immediate benefits from simplified forms and clearer deduction guidelines nationwide. Self-employed professionals can expect reduced compliance costs and more straightforward reporting requirements for their businesses. Small and medium enterprises will benefit from streamlined procedures and reduced administrative overhead costs.

Senior citizens often struggle with complex tax forms and will appreciate the simplified language and procedures. Young professionals entering the workforce will find tax compliance less intimidating with clearer guidelines. Retired individuals managing investment income will benefit from straightforward reporting requirements and clearer documentation needs.

The new framework particularly helps taxpayers in rural areas who may lack access to professional help. Simplified procedures reduce the need for expensive tax preparation services for basic filings. Digital tools will become more user-friendly with clearer instructions and reduced technical complexity.

Implementation Timeline and Transition Process

The government plans a phased rollout of the New Income-Tax Bill 2025 beginning with the next fiscal year. Tax authorities will receive comprehensive training on new procedures before implementation begins across all regions. Citizens will have access to educational resources and support during the transition period.

Initially, the new system will run parallel to existing procedures to ensure a smooth transition process. Taxpayers can choose between old and new filing methods during the first year of implementation. This approach minimises disruption while allowing people to become familiar with updated procedures gradually.

Technology upgrades to government systems will support the simplified procedures and reduce processing times significantly. Mobile applications and online portals will receive updates to reflect the streamlined processes and requirements. Customer support services will be enhanced to help taxpayers navigate the changes effectively.

Long-term Benefits and Expectations

The New Income-Tax Bill 2025 represents just the beginning of broader tax system modernisation efforts nationwide. Future updates may include additional simplifications based on taxpayer feedback and implementation experience gained. The government commits to regular reviews and updates to maintain system effectiveness over time.

Economic experts predict increased tax compliance rates due to simplified procedures and clearer requirements for citizens. Reduced compliance costs could lead to higher voluntary compliance and improved revenue collection efficiency. The business community anticipates positive impacts on investment decisions and economic growth patterns.

International best practices influenced many aspects of the new legislation, positioning India alongside modern tax systems. These changes could improve India’s rankings in global ease of doing business surveys significantly. The long-term vision includes a fully digital, user-friendly tax ecosystem that serves citizens effectively while maintaining revenue goals.

Be First to Comment